The automotive industry continues to be a pivotal force in shaping North America’s steel demand. From cold-rolled steel coils to galvanized sheets and specialty steel bars, the sector’s reliance on high-quality steel products remains significant. This article explores key trends in automobile steel demands, productions of automotive-related products, and influential market appetites from the angle of different stakeholders in both steel and automobile industries.

- A Growth Story: Steel Demand

Set to rise slightly in 2025, steel demand will primarily be driven by increases in automobile production, according to AutoForecast Solutions. While the U.S. and Canadian demand will be stable, that of Mexico is set to grow by 4%, in tune with that country’s increasingly major role as an automotive manufacturing base.

Key steel products in demand include:

- Cold-rolled steel coils for body panels;

- Galvanized steel sheets for improved corrosion resistance;

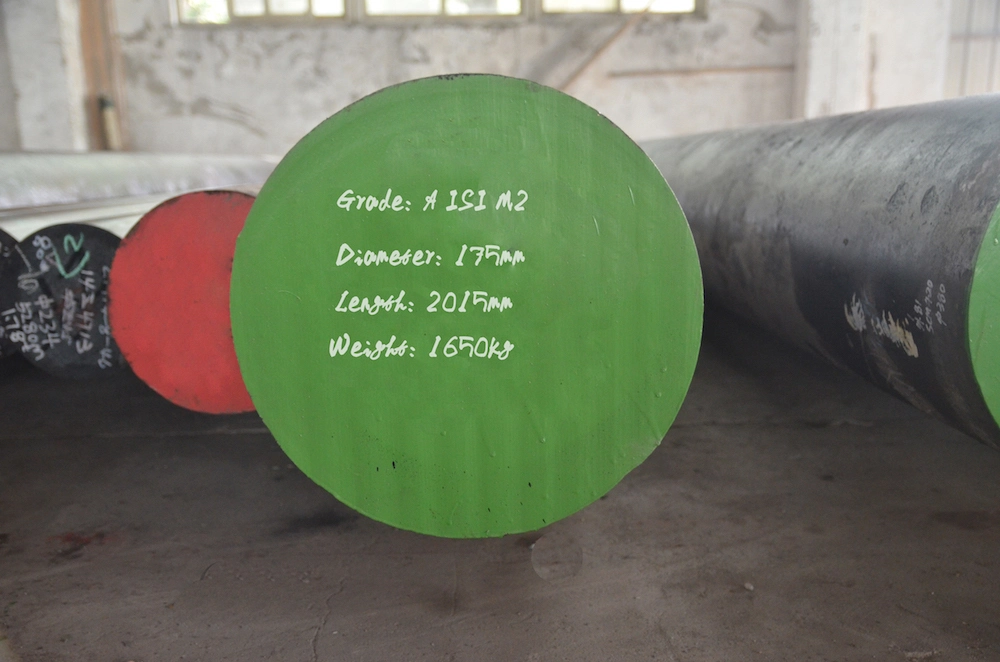

- Specialty steel bars for suspension and powertrain purposes.

The company Promispecial offers a fantastic array of value-added steel products for automotive grades tailored to serve the needs of an ever-changing international automotive building.

- U.S. Automotive Market Forecast

Although cautious, there seems to be optimism for the U.S. automotive market for the year 2025:

- Production of domestic light vehicles will increase modestly, by 1.16%, to 10.45 million units.

- Levels of inventory have normalized, with Stellantis having a 57-day supply at the end of 2024, resulting in manufacturers relocating production in line with actual demand.

- EV market expansion is slowing, with uncertainty regarding policies related to federal tax incentives.

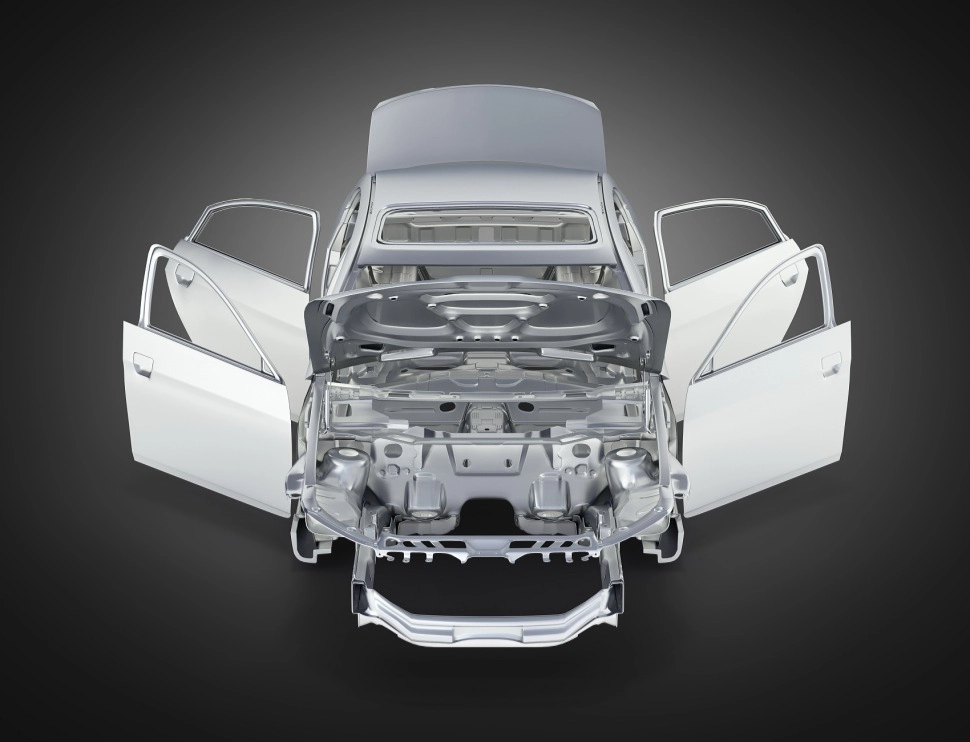

Steel remains an essential input to the automotive industry, covering 54% of the material composition in internal combustion and electric vehicles, says the American Iron and Steel Institute. The automotive sector accounts for 40% of U.S. sheet steel consumption and approaches 50% of specialty bar steel demand.

- Mexico: The Rising Star of Automotive and Steel

As of 2025, Mexico is likely to produce 4.13 million vehicles. The Mexican steel industry attracts investments, with an expected $5.61 billion to refurbish steel production facilities from 2023 to 2025.

Development projects:

- Availability of feasibility studies for a 600,000-ton specialty steel bar plant being studied by Gerdau.

- TYASA growth of a specialty bar rolling mill that is expected to have an annual capacity of 400,000 tons and is expected to commence operations in Q3 2025.

- Challenges and Market Dynamics

In 2025, the North American steel sector is anticipated to encounter multiple challenges:

- Tariff Uncertainty

Mexican market participants observed a spike in steel shipments ahead of the potential implementation date of January 20. Some suppliers have offered customers the option to cancel orders before the deadline or absorb the 25% tariff if it is enforced.

- High Automotive Loan Rates

Market Response: To mitigate declining demand, automakers have extended vehicle usage lifespans and focused on producing higher-quality vehicles. However, consumer appetite for new cars, particularly in the price-sensitive lower-end market, remains subdued.

- Steel Price Volatility

By December 2024, the cost of cold-rolled steel coils had declined by 3.26%, landing at $44.50 per cwt. Galvanized steel sheet prices similarly dropped by 2.27%, to $43.00 per cwt. In contrast, special steel bars showed minor growth, rising 0.47% from October 2024 to remain at $53.75 per cwt.

In 2025, the North American steel industry will confront various challenges, such as tariff uncertainty, elevated auto loan rates, and fluctuating steel prices. Nonetheless, the robust demand for high-quality cold-rolled and galvanized steel persists, driven by automakers’ reliance on these materials for maintaining vehicle quality and performance. This steadfast demand for premium steel will serve as a critical support mechanism for the industry amid market volatility.

- Promispecial: Your Partner in Automotive Steel Solutions

At Promispecial, we are committed to supporting the automotive and steel industries with innovative and high-quality solutions. Our product range includes:

- Cold-rolled steel sheets: precision-engineered for body panels and structural components.

- Galvanized steel coils: Offering superior corrosion resistance for harsh environments.

- Specialty steel bars: Designed for suspension systems, drivetrains, and high-stress applications.

With a focus on sustainability, reliability, and global supply chain excellence, Promispecial is your trusted partner for meeting the demands of modern automotive manufacturing.

Explore More

Stay ahead of the competition with Promispecial’s premium automotive steel products. Visit promispecial.com to learn more about our offerings and how we can support your next project.