How China’s NEV Boom Reshapes Specialty Steel Priorities (2025 Industry Outlook)

1. China’s NEV Dominance Drives High-Performance Steel Innovation

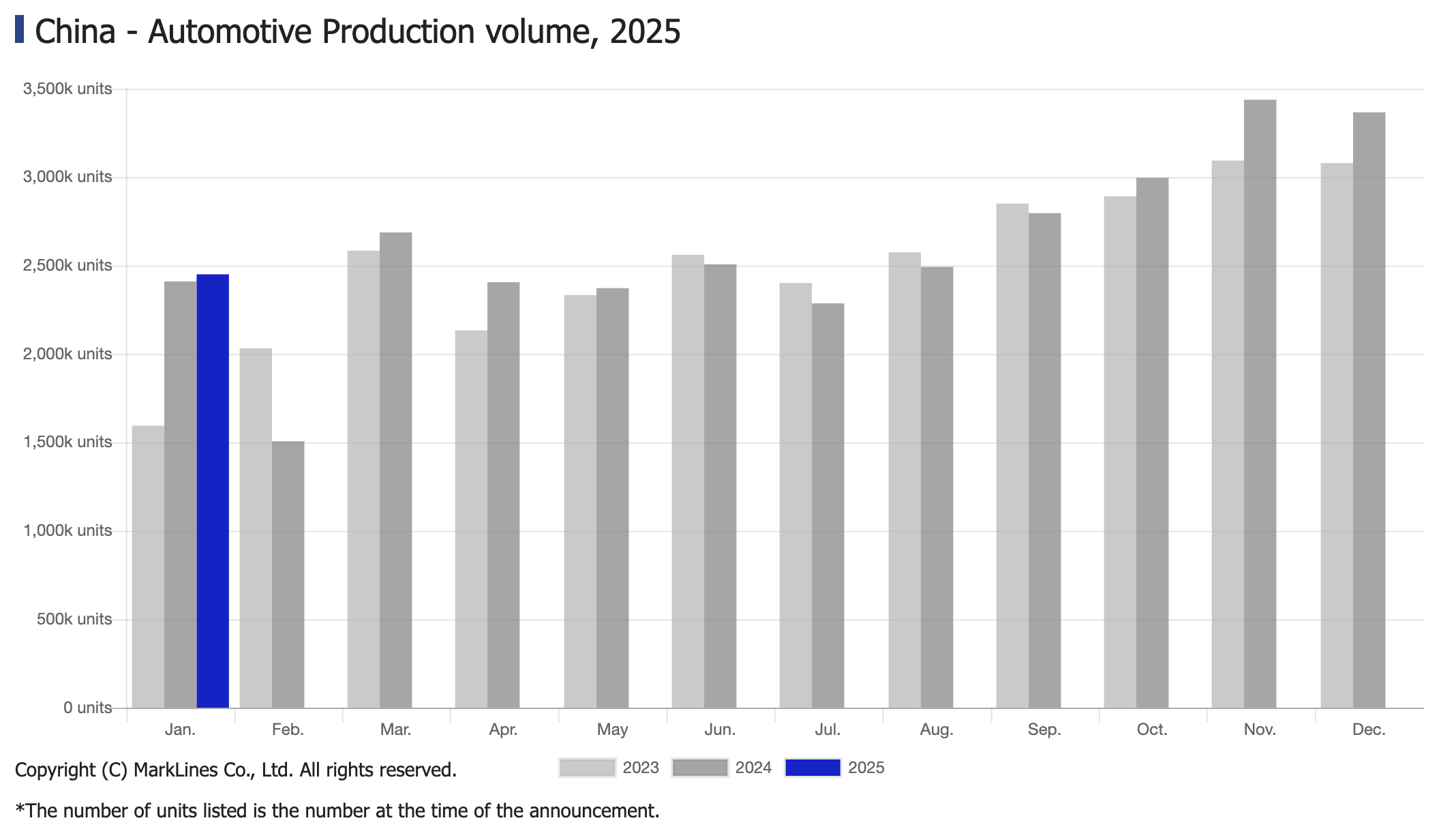

According to CAAM data, NEV sales surged 29.4% YoY in January 2025, with production exceeding 1 million units for the first time in a single month. This aligns with projections that China will account for 58% of global EV ownership by 2025, driven by:

– Battery Protection: Demand for hydrogen-resistant stainless steel (2GPa grade) in battery enclosures (e.g., BYD’s Blade 5.0 batteries) to prevent thermal runaway.

– Lightweighting breakthroughs: 980 MPa QP steel adoption in XPeng X9 body-in-white, reducing weight by 18% vs. traditional HSS.

– Motor Efficiency: 0.15mm silicon steel sheets cutting core losses to ≤1.2W/kg in NIO ET9 motors.

Key Trend: Chinese automakers now require 21% higher tensile strength and 30% lower carbon footprint in steel supplies compared to 2023.

2. Global Steel Market Volatility: Challenges & Opportunities

Contrasting Regional Dynamics:

– China: Steel demand is expected to decline 1% in 2025 due to property sector slowdown, but NEV-driven specialty steel grows 8.5% YoY.

– EU/NA: Carbon border taxes (CBAM) push automakers toward low-carbon EAF steel (≤1.2t CO2e/ton) despite higher costs (+$120/ton vs. BF-BOF).

– ASEAN: EV sales surge 41% YoY, driving demand for tropical-grade galvanized steel (ZAM coating) to combat humidity corrosion.

Price Pressures:

– Global hot-rolled coil prices are forecast to drop 14% to $580/ton by Q4 2025, but specialty steel premiums rise (e.g., AHSS +$200/ton).

– Automotive steel now accounts for 38% of total production costs in budget EVs vs. 25% in 2023.

3. OEM Strategies: Reshaping Supply Chains

– Localization: Tesla Shanghai expands ultra-high-strength boron steel (22MnB5) production capacity by 40% to bypass tariffs.

– Material Substitution: Ford F-150 Lightning adopts a steel-aluminum hybrid chassis (steel content reduced to 55% from 68%).

– Green Steel Commitments: Volvo Cars leads with a 12% fossil-free steel procurement target by 2025, creating a $2.8B market niche.

Critical Issue: Only 4% of automakers currently meet IEA’s 2030 green steel targets, highlighting the urgent need for supplier innovation.

Promispecial’s Strategic Solutions

Core Competencies:

✅ Low-Carbon Steel: EAF-produced AHSS with ≤1.5t CO2e/ton (aligned with CBAM requirements).

✅ Corrosion-Resistant Alloys: ZAM-coated steel for ASEAN markets (salt spray resistance > 1,200 hrs).

✅ Custom Processing: Precision laser-cut battery tray components (±0.1mm tolerance).

Global Reach:

– EU: Compliance-ready documentation for CBAM (embedded emissions tracking).

– NA: JIT delivery hubs in Texas/Michigan supporting <72hr lead times.

– ASEAN: Local warehouses stocking 50,000+ tons of tropical-grade stock.

.webp)